End of Year Gifts / Christmas Gifts + Accounting

The year 2020 has certainly been a different one. But with Christmas fast approaching, businesses are starting to wonder how they can celebrate the end of this year with their staff.

Unfortunately, for most parts of Australia, the normal large function is looking like a no go. Not to mention, many businesses have been closed for some time and may not have the means to give even the smallest gift to their employees and clients – the struggle is real.

For those fortunate to be able to share some Christmas spirit in the form of gift giving, this information is for you.

As far as staff (including directors) gift giving goes, there is a threshold of $300 per employee (including GST). Anything below $300 is considered a minor benefit. Keep below this threshold to avoid needing to pay Fringe Benefits Tax (FBT).

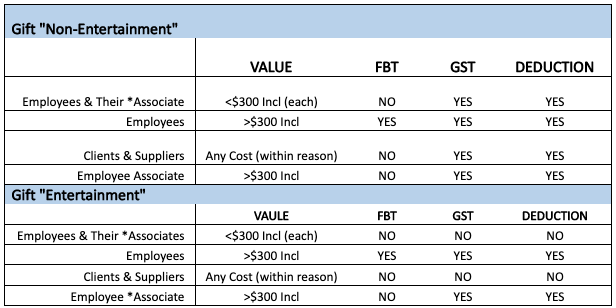

Gifts can be categorised as: Non-Entertainment or Entertainment. The table below summarises the various tax treatments for each type.

*According to the ATO – Associate is a:

Relative, such as spouse or children

Partner you are a partnership with

Another partner in that partnership and that partner’s spouse & children

A trustee of a trust that you, or your associate, are a beneficiary of

A company that you, or your associate control or influence

What does “Non- Entertainment” mean in Accounting?

Opting for a “Non-Entertainment” gift under $300 is fully tax deductible and you receive a GST credit on your BAS. This could be for items such as, beauty products, flowers, wine, cologne, vouchers and hampers.

Employees:

If you provide an employee with the “Non-Entertainment” gift and it is more than $300, you’ll still get the deduction and GST credit, BUT!!! FBT is payable at the rate of 47% on the grossed-up value.

Keeping in mind, that the $300 minor benefit also separately applies to any gifts provided to associates, meaning that a similar gift can also be provided to a spouse or partner of the staff member. So, you could provide a staff member and their spouse two $250 retail vouchers (one each) and claim as a tax deduction, but being vouchers, these would be GST free and no GST credit would be received.

Clients/Contractors:

Any “Non-Entertainment” gifts provided to clients or suppliers do not come under the FBT Rules as they are not your staff. You’ll be able to claim the tax deduction and GST credit so long as the gift isn’t excessive or overly valuable…so don’t go dropping new iPad’s off to your clients and you should be ok!

What does “Entertainment” mean in Accounting?

According to the ATO, providing entertainment means:

Providing entertainment by way of food, drink or recreation

Providing accommodation or travel in connection with such entertainment

Recreation includes amusement, sport and similar leisure activities, for example a game of golf, theatre or movie tickets, a joy flight or harbour cruise.

Employees:

Now…if you’d like to provide an entertainment gift to your staff and their spouse, while its not ideal, it is doable.

These items could be tax deductible and GST credit could be received if over $300, but FBT would apply. If you’d like some further information in what Fringe Benefit Tax means, please see our article “FBT…say what?”.

If the cost is less than $300, a tax deduction and GST credit would not be claimed.

Clients/Contractors:

The cost of any entertainment gift provided has no tax benefit as it is neither applicable for tax deduction or GST credit.

In this instance it is best to stay with a non-entertainment gift.

Client gift giving system

Business owners often use a Tiered system, when allocating value of gifts to their clients & suppliers. You’d determine the size of the gift, whether that be ‘non-entertainment’ or ‘entertainment’ depending on the value of work the relationship has impacted your business.

For example:

Tier 1 – Large impact, generally they bring in the most money to your business or provide you very good rates on the services they’re providing you.

Tier 2 – Medium impact, decent sized offering, ongoing relationship, good referral of business or maybe they’ve provided you with excellent connections within your industry so you’d like to maintain a high calibre relationship.

Tier 3 – Small impact/New client – they might have just started engaging with you, or perhaps it’s a client you’d like to work with in the future. A gift to say that you value your relationship or would like to engage in each other’s products/services.

Make a list of all your clients and suppliers, including any key contractors, review how they’ve impacted your business over the past 12 months and triage them accordingly.

It can be a bit daunting, much like planning a wedding and you need to cull the guest list!

Just keep coming back to the questions:

“do they add value to my business”

“are they a positive relationship I’d like to maintain”

Just don’t make the rookie mistake of labelling your gifts with tier 1,2 or 3 or else you’ll be left with some awkward conversations!

Ready to spend that cash? Or need some further clarification?

Everyone’s situation is unique, If you need any help calculating potential FBT implications or are unsure of what constitutes as an “entertainment or “non-entertainment” gift, send us a message and we’ll help you work within the guidelines.